2022 tax brackets

15 hours agoThe IRS has released higher federal tax brackets and standard deductions for 2023 to adjust for inflation. Single filers may claim.

2021 2022 Tax Brackets And Federal Income Tax Rates Bankrate

2022 tax brackets are here.

. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71. Heres what filers need to know. Whether you are single a head of household married etc.

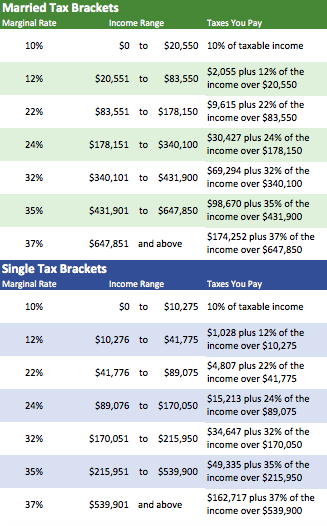

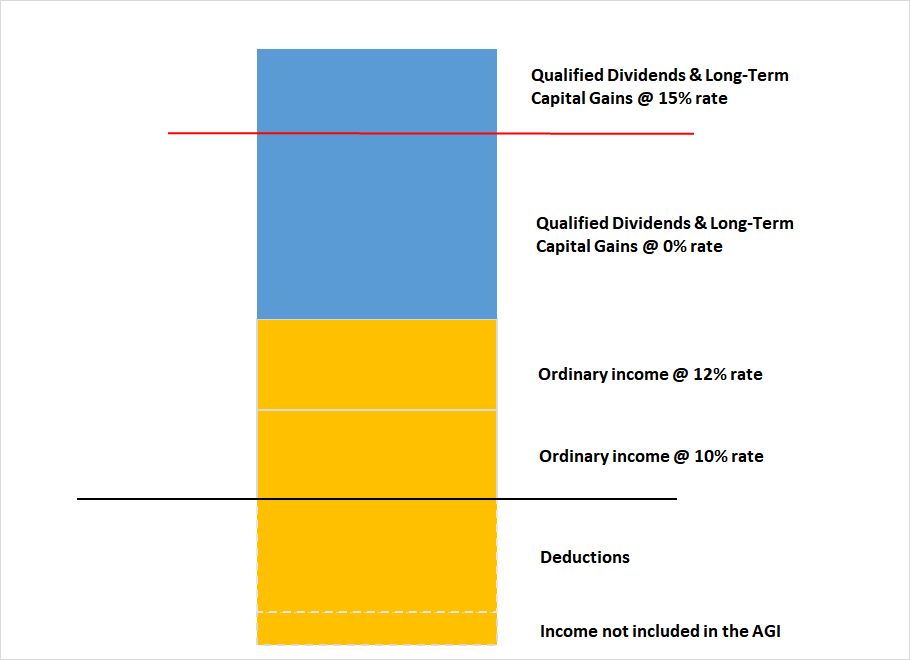

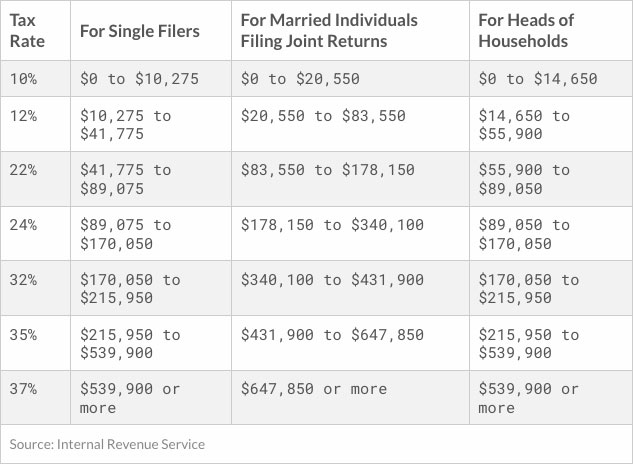

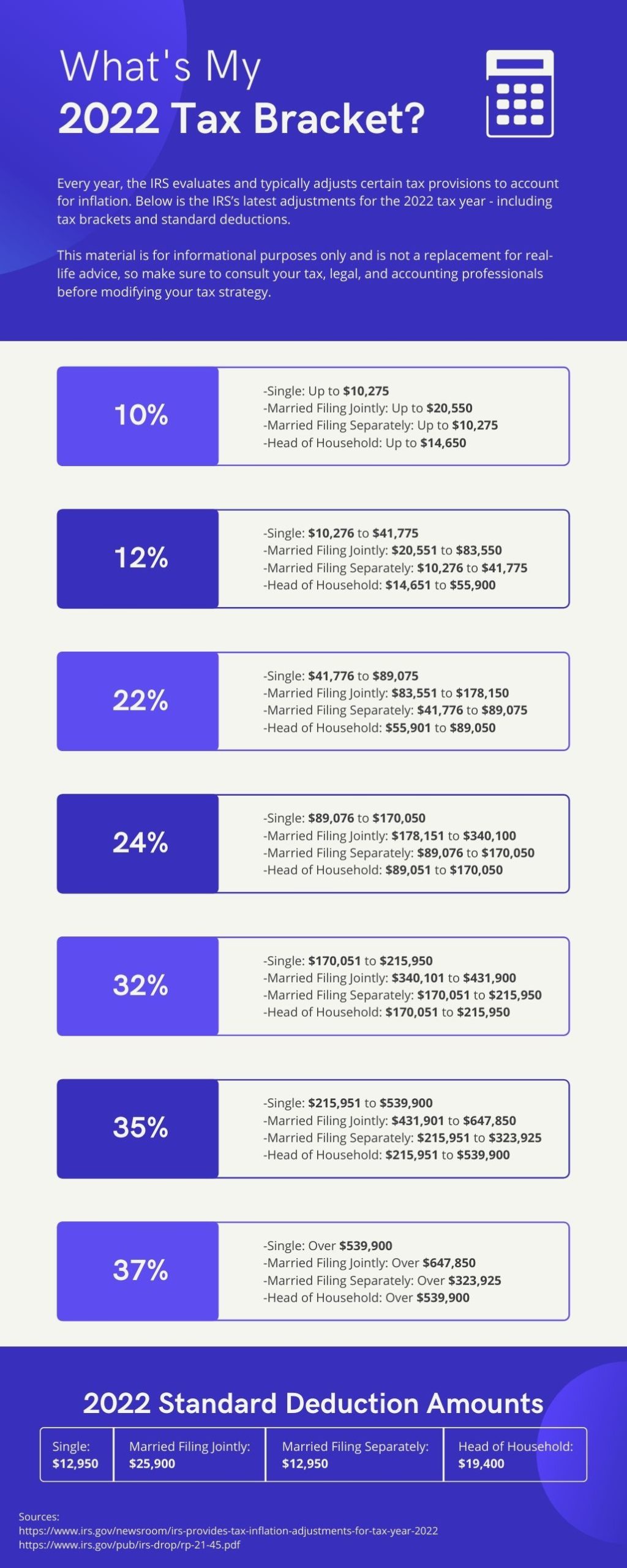

The other rates are. Download the free 2022 tax bracket pdf. 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

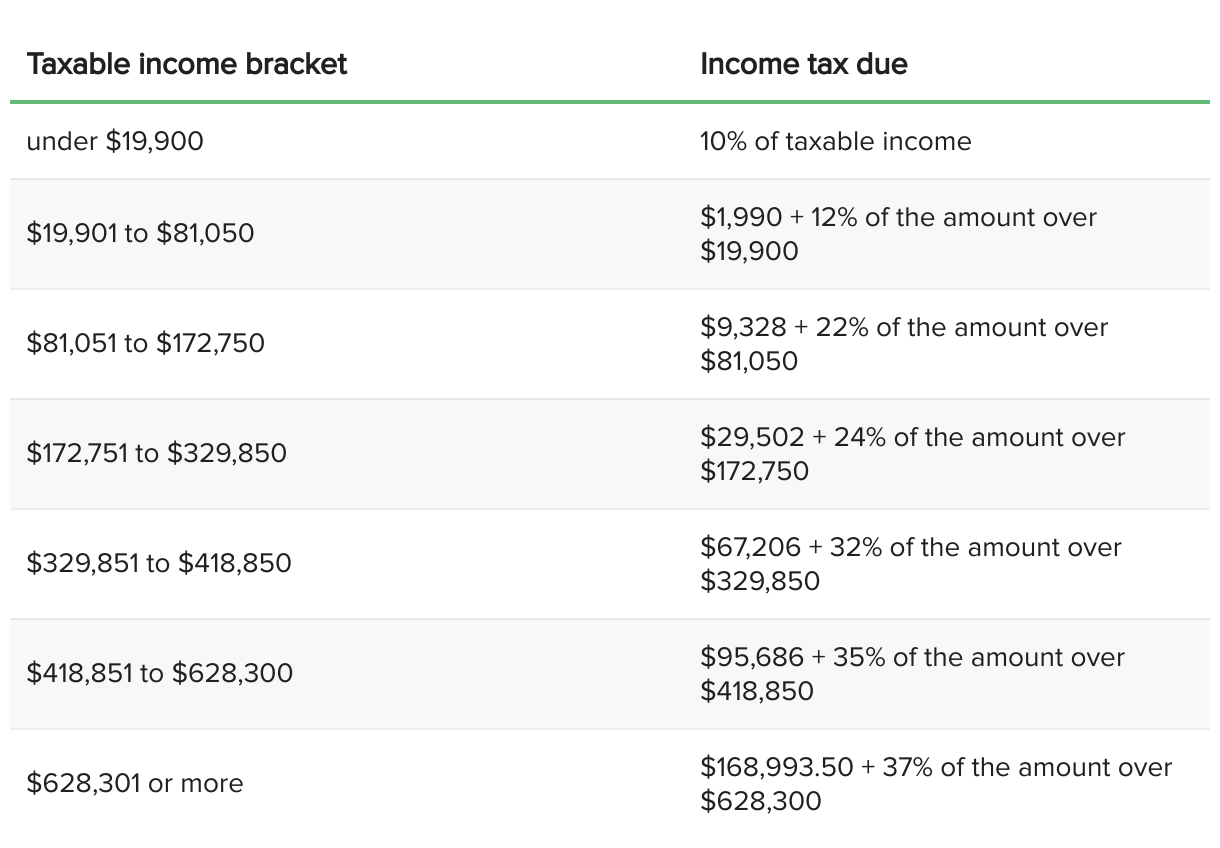

10 12 22 24 32 35 and 37 depending on the tax bracket. The federal income tax rates for 2022 did not change from 2021. Taxable income up to 10275.

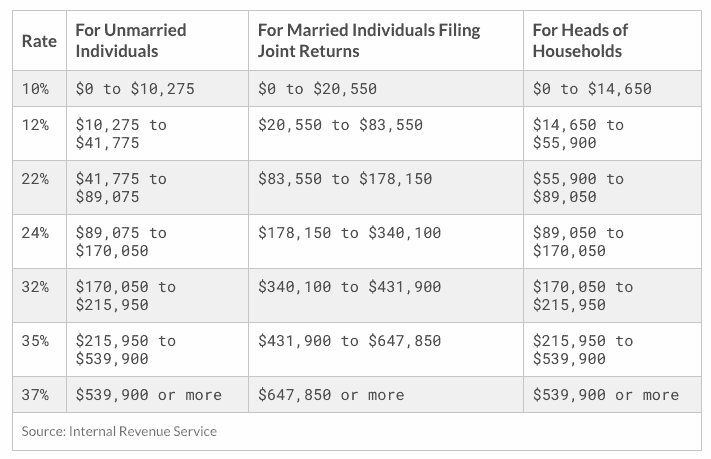

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household. Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550. 35 for incomes over 215950 431900 for married couples filing jointly.

Taxable income between 89075 to 170050. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

11 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. Up from 25900 in 2022. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

Taxable income between 10275 to 41775. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you. There are seven federal income tax rates in 2022.

Trending News IRS sets its new tax brackets. Taxable income between 41775 to 89075.

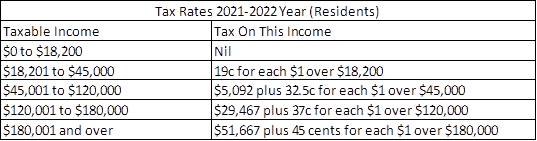

Everything You Need To Know About Tax In Australia Down Under Centre

Tax Changes For 2022 Including Tax Brackets Acorns

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management

2022 Tax Brackets Internal Revenue Code Simplified

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance

2022 2023 Tax Brackets Standard Deduction Capital Gains Etc

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

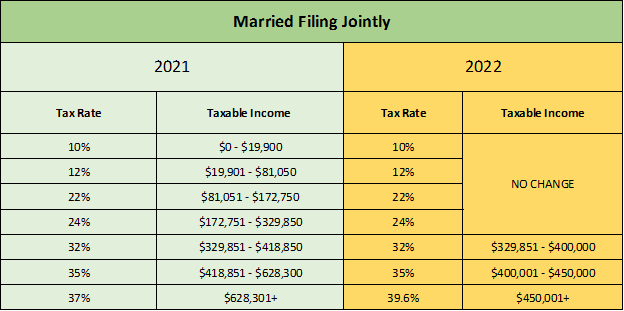

Analyzing Biden S New American Families Plan Tax Proposal

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

Awp Income Tax Changes Under The September 13th House Ways And Means Proposed Awp

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

Tax Bracket Calculator What S My Federal Tax Rate 2022

Australian Income Tax Brackets And Rates 2021 22 And 2022 23

What S My 2022 Tax Bracket Infographic Delphi Advisers Llc